How Much Can I Contribute To Roth Ira In 2025

How Much Can I Contribute To Roth Ira In 2025. The ira contribution limits for 2024 are $7,000 for those under age 50, and $8,000 for those age 50 or older. You can make 2024 ira contributions until the.

Use nerdwallet’s free roth ira calculator to estimate your balance at retirement and calculate how much you are eligible to contribute to a roth ira. You can make 2024 ira contributions until the.

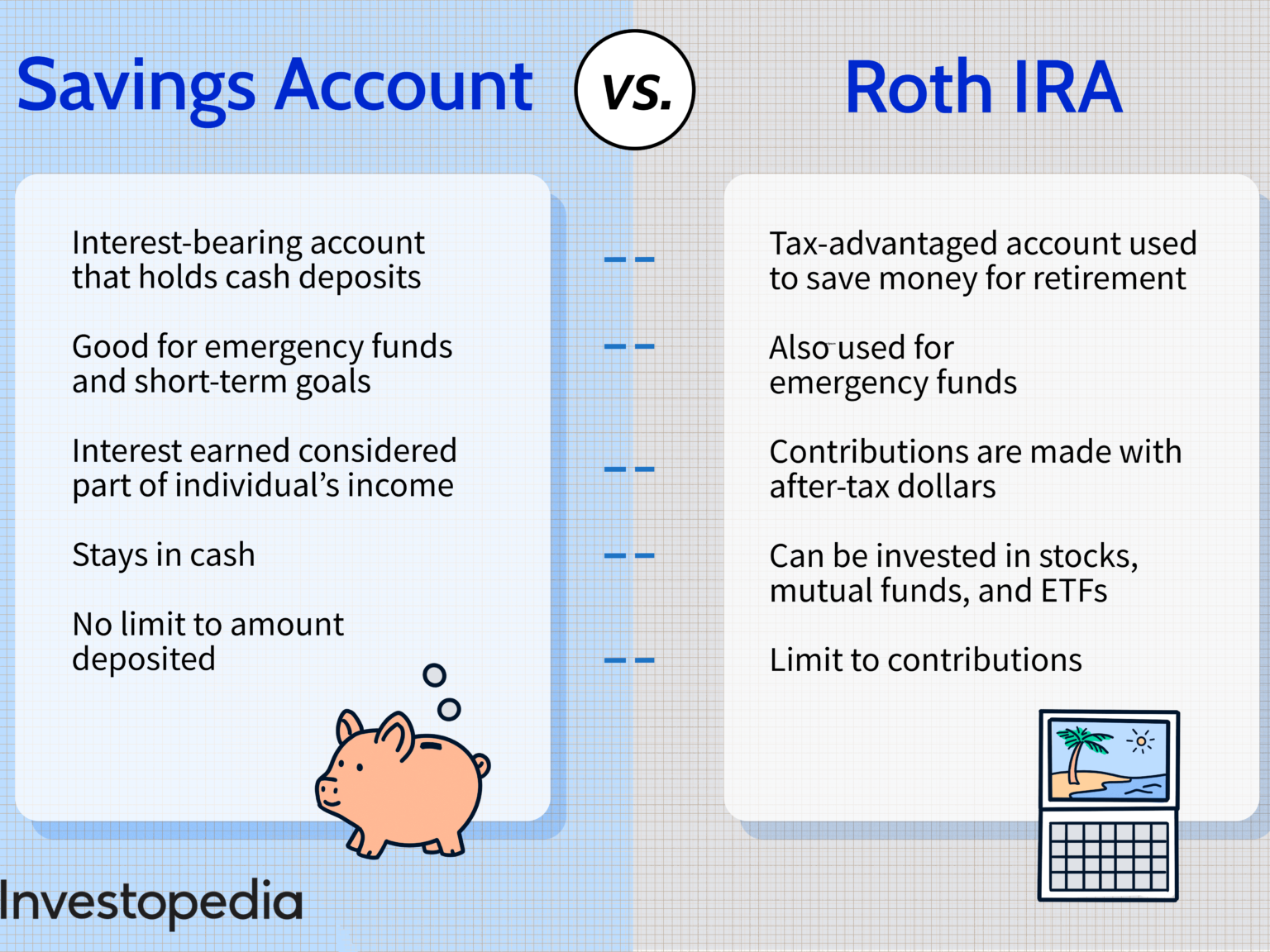

This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

The Ultimate Roth IRA Guide District Capital Management, Understanding how much you have of contributions, converted or rolled over amounts, and earnings will help you determine the potential tax consequences of. The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023.

How Much Should You Contribute to Your Roth IRA?, You can apply a previous year’s excess contributions to a future year’s roth ira contributions. The maximum ira contribution is $7,000 in 2024 ($8,000 if age 50+).

Can I Contribute To My Roth IRA Independent Fiduciary Advice, The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023. Consider getting any available 401(k) match, then make traditional or roth ira.

How Much Can You Contribute to a Roth IRA? The Enlightened Mindset, The first business day of the year is the first day you can contribute to that years' ira. The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023.

Can I Contribute to Roth IRA and 401K??? YouTube, It's important to mention that your modified adjusted gross income (magi) and tax filing status can affect your ability to contribute to a roth ira. A conversion might make sense if you earn too much to contribute to a roth ira.

How much does a Roth IRA grow in 10 years? IRA vs 401k, The maximum ira contribution is $7,000 in 2024 ($8,000 if age 50+). If you're age 50 and older, you.

How Much Can I Contribute To Roth Ira In 2024 Elyse Imogene, For 2024, the most you can contribute to a roth ira is $7,000 (under the age of 50), or $8,000 (for those 50 and older). The maximum amount you can contribute to a roth ira for 2024 is $7,000 (up from $6,500 in 2023) if you're younger than age 50.

How much can I contribute to my Roth IRA 2023 YouTube, In 2024, the roth ira contribution limit is $7,000, or. The first business day of the year is the first day you can contribute to that years' ira.

How a Backdoor Roth IRA Conversion Works Yes! You can still, The roth ira income limit to make a full contribution in 2024 is less than $146,000 for single filers, and less than $230,000 for those filing jointly. You can apply a previous year’s excess contributions to a future year’s roth ira contributions.

Backdoor Roth Ira Contribution Limits 2024 2024 Terra Rochelle, The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. You can make 2024 ira contributions until the.